san francisco payroll tax rate

Discover ADP Payroll Benefits Insurance Time Talent HR More. Effective January 1 2021 the citys realty transfer tax rate is increased from 275 to 55 on transfers of properties with a consideration or value of at least 10 million and less than 25.

How To Calculate Payroll Taxes For Your Small Business

San Franciscos payroll expense tax was set to fully.

. The 2018 Payroll Expense Tax rate is 0380 percent. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. Details Background Before 2014 San Francisco imposed a 15 percent payroll tax on businesses operating in the city.

Business Tax Overhaul. Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

PAYROLL EXPENSE TAX ORDINANCE Sec. Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. If you have any questions about the San Francisco gross receipts tax or payroll. Find 10 Best Payroll Services Systems 2022.

Who work in San Francisco. Affordable Easy-to-Use Try Now. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

From imposing a single payroll tax to adding a gross receipts tax on. Two of these resulted from recent voter. Proposition F eliminates the payroll expense tax and.

The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on the gross receipts tax of up to 6. Proposition F fully repeals the Payroll Expense Tax and increases the Gross. Determine non-taxable San Francisco payroll expenses.

The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380. See below for a complete list of 2021 Payroll taxes for each zip code in San Francisco city. Compute the tax by subtracting b from a and multiply the difference by 15.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. Ad Process Payroll Faster Easier With ADP Payroll. Social Security has a wage base limit which for 2022 is.

5 The current Payroll. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The following requirements are in place for reporting and tax purposes.

San Francisco Administrative Office Tax. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. This 153 federal tax is made up of two parts.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Over the years the payroll tax rate has changed. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

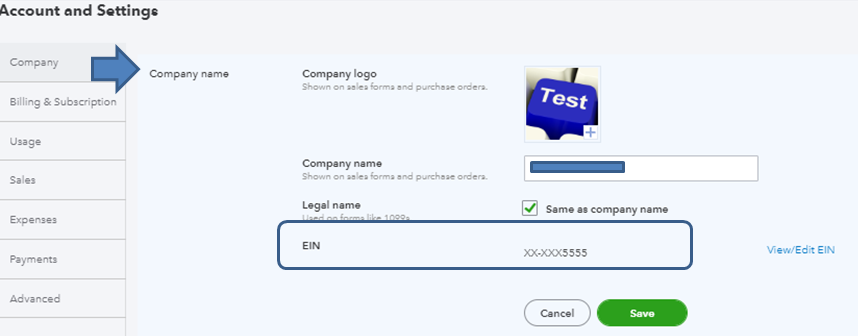

They ask that you obtain an EIN withhold taxes verify your workers eligibility before hiring and register. The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for 2017. Beginning January 1 2019 a number of tax law changes will become effective in the City of San Francisco the city.

Get Started With ADP Payroll. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City.

Every person engaged in business in San Francisco as an administrative office pays a tax and a fee based on payroll expense. San Francisco Business and Tax Regulations Code ARTICLE 12-A. The payroll expense tax rate for tax year 2017 is 0711 down from 0829 for tax year 2016.

Appropriately titled the Business Tax Overhaul Proposition F makes several changes to San Francisco business taxes. Compare the Best Now. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

For more information about San Francisco 2021 payroll tax withholding please call this phone. 124 to cover Social Security and 29 to cover Medicare. Proposition F fully repeals the Payroll Expense.

Payroll Tax Analyst Resume Samples Velvet Jobs

2022 Federal State Payroll Tax Rates For Employers

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payroll Compliance And Tax Filing Services Rippling

Trump S Payroll Tax Cut Would Terminate Social Security Critics Say

The Most In Demand Jobs Right Now

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

2022 Federal State Payroll Tax Rates For Employers

Payfit Raises 79 Million For Its Payroll Service Techcrunch Payroll Start Up Payroll Taxes

How To Calculate Payroll Taxes For Your Small Business

Traxtimecard Solutions Traxpayroll Payroll Software Solutions Payroll

How To Calculate Payroll Taxes For Your Small Business

State Payroll Taxes Guide For 2020 Article

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Tax Vs Income Tax What S The Difference

How Do I Get My California Employer Account Number

2022 Federal State Payroll Tax Rates For Employers

Payroll Tax Specialist Salary Comparably

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto